How Bond Markets Are Bending the Crypto Curve

China is stepping back. The Cayman Islands are stepping up, while somewhere in the background, $BTC printed a new all-time high.

Who is surfing a half-trillion dollars through a turquoise tax haven where the tallest skyline is a row of mangroves?

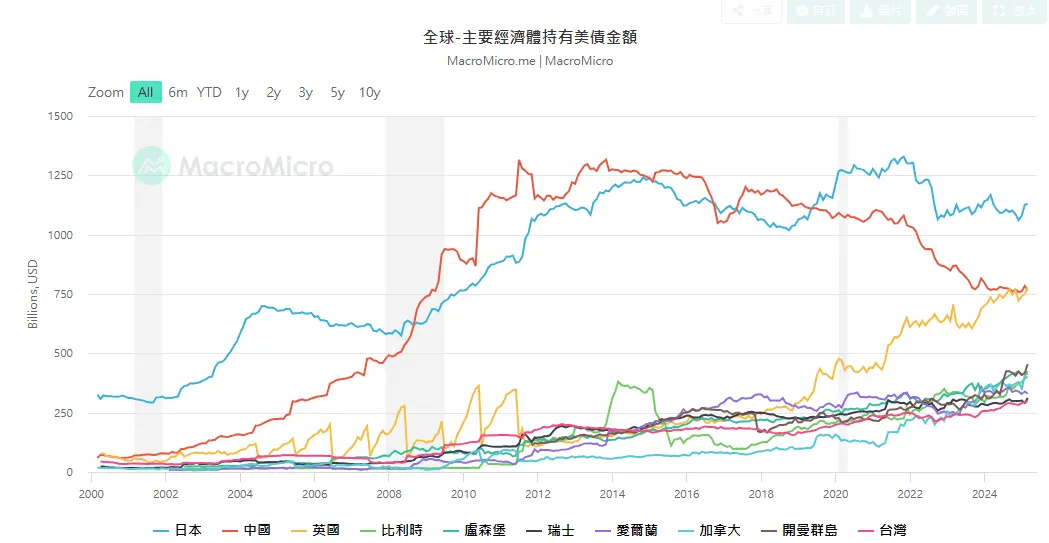

Official Treasury ledgers show the Cayman Islands; home to seventy three thousand residents and considerably more iguanas, holding 455 billion dollars in United States government bonds. That single figure plants the islands in fourth place among America’s foreign creditors, just behind China and ahead of Canada, Belgium and Luxembourg, but no one in George Town will say whose suitcase the money arrived in. Hedge-fund leverage, big-tech cash pools, Middle-Kingdom round-tripping: every theory is whispered, none confirmed.

Welcome to the Sovereign Desk.

The story gets spicier once Beijing enters the fold. China trimmed about 19 billion dollars of Treasuries in March, its running total slipping to a twenty-five-year low of 765 billion.

Beltway chatter says the US Treasury badly wants cheaper refinancing next year and that the former Trump team talked privately about keeping yields down. Beijing’s incremental selling nudged two-year yields a few basis points higher, exactly the opposite of that wish. The kicker is that London custodians (largely private rather than official money) scooped up even more bonds, pushing the UK-booked holdings past China to 779 billion. Traders now frame the drip-drip of Chinese sales as a slow motion contest: every billion Beijing sells sets the stage for some other buyer to flash its chequebook.

Over sushi in Canary Wharf, macro strategists may lean into a game-theory angle. If “Team China” keeps bleeding the Treasuries, its allies might recycle fewer export dollars back into US debt, while “Team US” allies would hoover up the extra paper to prevent rates from spiking. The theory is colourful, although hard numbers suggest the bond market’s real referee remains within the Federal Reserve’s domain.

Still, the idea has seeped further. Some Southeast Asian exporters, particularly in Malaysia, have begun settling trade in ringgit as part of a broader push to reduce reliance on the U.S. dollar.

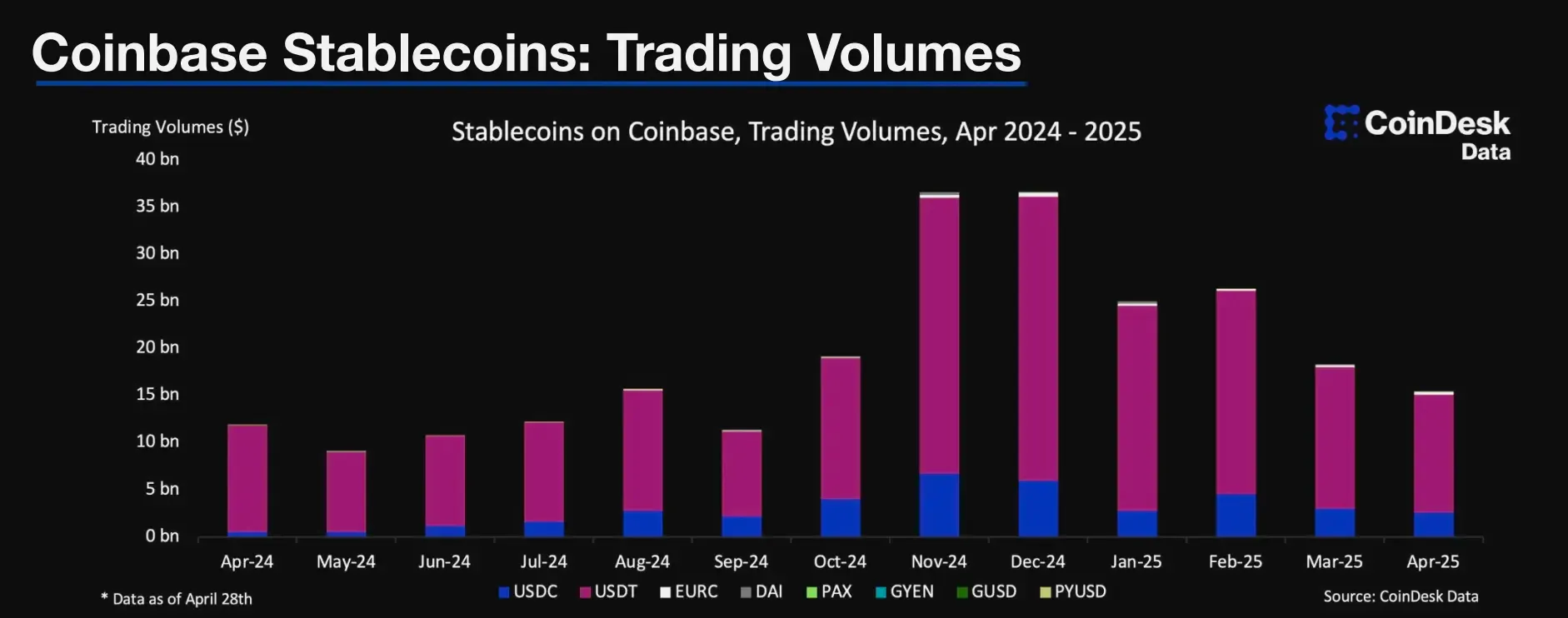

That shift, if it widens, could mean fewer greenbacks sloshing through regional banks. Some crypto analysts-slash-observers have jumped ahead of the evidence, predicting a dip in stablecoin issuance on both sides of the Pacific if cross-border dollar demand softens. Actual data show the opposite for now, with USDT, USDC and PYUSD supplies all set record highs in April, supported by higher front-end yields that fatten reserve income for the issuers.

For now, the stablecoin scene is capitalising on the rate environment. With Tether now holding approximately $120 billion in US Treasury bills, even a modest 10-basis-point rise in short-term yields could add over $100 million a year to its reserve income. That extra carry can cushion the peg, bankroll new products, or subsidise zero-fee transfers to stay ahead of the competition.

Option desks, meanwhile, are pricing in richer premiums for depeg protection, especially after last month’s sUSD wobble, but many admit that stronger interest income lowers the near-term risk. When stablecoin issuers earn more from their reserves, the likelihood of a sudden crack in the peg gets smaller, not larger.

Earlier this week, BTC climbed past $110,900, setting a new all-time-high. The narrative credit improved regulatory signals in the US, continued ETF inflows, and broader institutional buying. However, some believe that the quiet shake-up in sovereign bond flows, particularly China’s continued Treasury selloff and the Cayman Islands’ growing pile may have nudged crypto sentiment.

While direct evidence is scarce, analysts have noted patterns suggesting that some funds may have opened long positions in Bitcoin earlier this week, potentially in response to capital rotation and global liquidity concerns. This speculation aligns with Bitcoin’s recent surge to new all-time highs. With China trimming Treasuries and liquidity signals flashing mixed, it wouldn’t be surprising if some desks saw an opportunity to front-run a shift in macro positioning.

There has been no confirmation of who moved first, but the narrative is circulating. Global liquidity stress, paired with renewed appetite for non-sovereign stores of value, is the kind of backdrop that tends to attract institutional attention.

With Tether now holding over $120 billion in US Treasury bills and Circle not far behind, every shift in sovereign debt flows and front-end yields affects how these coins are backed, distributed, and perceived. So far, higher yields have only made reserve-backed stablecoins stronger. But if flows into US debt start to fragment; coming from geopolitical chaos or rate volatility, the pressure may show up not in Bitcoin first, but in the confidence behind the coins that feed it liquidity.

The next TIC report lands on June 18. Until then, sovereign bond flows and stablecoin supply charts may tell a more connected story than they first appear.

The Sovereign Desk editorial is open for conversation. If you’ve observed notable flows, rumours, or data points that warrant attention, please reach out to us:

Dendy Suhubdy at [email protected]

Faisal Mujaddid at [email protected]