Atlas Shares: Creative Destruction in the Age of Radical Abundance

In 2100, megacorporations have evolved beyond mere business entities into sovereign powers that administer vast city-states. Traditional governments exist only as ceremonial vestiges, their functions entirely privatized and bid out to the highest corporate contractor. Every square meter of habitable land carries a real-time price tag, fluctuating based on algorithmic assessments of productivity potential, and citizens pay micro-rents for the space they occupy moment by moment. The atmosphere itself has been commodified through carbon trading that evolved into general "air quality units," with premium oxygen blends available for those who can afford them. Even social interactions are mediated through reputation tokens and attention markets, where a conversation with a high-status individual requires purchasing their time slots through automated bidding systems.

Personal identity has become the ultimate asset class, with individuals incorporating themselves at birth and issuing shares in their future earnings. Parents invest in their children through sophisticated derivative instruments, hedging against poor performance with complex swap agreements. Education is delivered through neural interfaces by competing AI tutors who take equity stakes in their students' lifetime productivity. The human body has been fully financialized - organs trade on regulated exchanges, genetic modifications are leased rather than purchased, and even memories can be collateralized for loans. Privacy is extinct, as every biometric data point, thought pattern, and emotional state is harvested and packaged into tradeable data commodities.

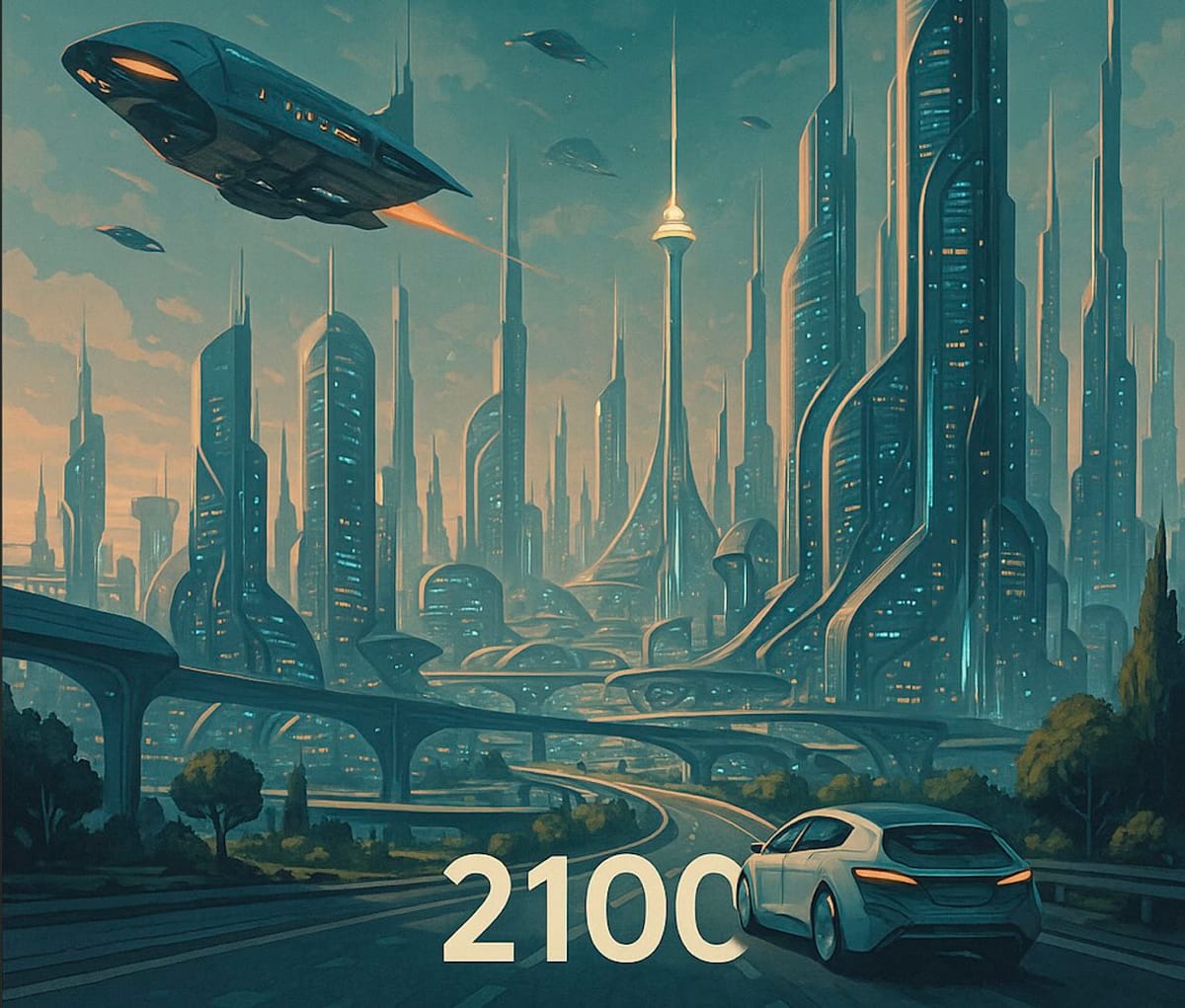

The physical world resembles a vast machine optimized for capital efficiency. Vertical cities stretch kilometers into the sky, with real estate values determining altitude - the wealthy inhabit the sunlit upper tiers while others descend into the depths based on their credit scores. Automated factories and distribution networks operate at theoretical maximum efficiency, with human workers bidding down their wages in real-time auctions against robotic alternatives. Nature exists only in private preserves, with wealthy collectors maintaining the last forests and oceans as investment vehicles. The Moon and Mars host thriving mining colonies operated by indentured workers paying off their transportation debts, while asteroid mining cartels control the flow of rare materials that power the Earth's quantum computing infrastructure.

Social mobility is theoretically infinite but practically impossible, as the convergence of inherited wealth, genetic optimization, and compound returns has created a rigid caste system enforced by market mechanisms rather than law. Those who fail to maintain positive cash flow are automatically relocated to "efficiency zones" - massive arcologies where basic sustenance is provided in exchange for cognitive labor, mining cryptocurrency or training AI models. Mental health issues are treated as market inefficiencies, with therapy delivered by algorithms that optimize for productivity rather than wellbeing. Yet the system perpetuates itself through the shared mythology that anyone can achieve astronomical wealth through the right combination of risk-taking and innovation, keeping billions locked in an endless cycle of speculation and debt, chasing returns in increasingly exotic financial instruments derived from human suffering itself.

In this evolved hyper-capitalistic society of 2100, the rigid monopolies of the earlier era have been shattered by a paradoxical fusion of radical decentralization and technological abundance. The breakthrough came when distributed autonomous organizations (DAOs) realized that monopolistic rent-seeking was itself a market inefficiency that could be arbitraged away. Healthcare, once the domain of corporate medical cartels, has been completely disrupted by open-source AI doctors trained on the collective medical knowledge of humanity, accessible to anyone with a basic neural interface. Robotic surgery units, manufactured by competing collectives using molecular assemblers, operate at the cost of raw materials plus energy. Drug synthesis has been democratized through portable bioreactors that can produce any pharmaceutical from freely available molecular blueprints, making the old pharma giants as obsolete as typewriter manufacturers.

The transformation was enabled by a new form of "competitive anarchism" where investment pools formed by ordinary citizens actively fund illegal innovation in regulatory gray zones. These pools, coordinated through untraceable cryptocurrency networks, place bounties on breaking monopolies - rewarding anyone who can reverse-engineer proprietary technology, leak corporate secrets, or develop open alternatives to closed systems. The old corporate city-states still exist, but they're constantly undermined by "shadow cities" - autonomous zones where experimental technologies and social systems are tested without regard for patents, regulations, or corporate ownership. These zones operate on principles of radical transparency and immediate value distribution, where every innovation is instantly available to all participants, creating a hyper-accelerated evolution of technology that outpaces any attempt at corporate capture.

The megacorporations adapted by shifting from ownership to curation models, competing to provide the best integration and user experience for technologies they can no longer monopolize. Instead of controlling production, they've become massive prediction markets, betting on which innovations will succeed and funding their rapid deployment. The wealthy still exist, but their advantage has shifted from controlling resources to having better information and risk assessment capabilities. The vertical cities remain stratified, but now feature constant "elevation raids" where successful innovation pools can suddenly purchase entire tiers, forcing rapid redistribution of living spaces. The poor are no longer trapped in efficiency zones but instead form "innovation communes" where basic needs are met through automated production while residents focus on creative disruption of remaining monopolies.

Cryptocurrency has evolved into a complex ecosystem of competing monetary systems, each optimized for different types of transactions and values. Some currencies reward innovation directly, automatically distributing tokens to anyone whose open-source contributions are widely adopted. Others function as "anti-currencies," designed to expire if hoarded, forcing constant circulation and preventing wealth accumulation. The most successful individuals are no longer those who accumulate capital but those who can navigate the constantly shifting landscape of opportunities, forming temporary alliances to tackle specific monopolies before dissolving and reforming around new targets. Traditional law enforcement has given up trying to control these activities, as any attempt to shut down one network simply spawns ten more sophisticated versions.

This new order maintains the hyper-competitive spirit of pure capitalism while preventing the ossification that plagued the earlier system. Death itself has become optional for those willing to experiment with underground longevity treatments, but immortality comes with the risk of using unproven technologies developed outside corporate safety protocols. The Moon and Mars colonies have declared independence, becoming testbeds for even more radical economic experiments. Earth's rulers watch nervously as off-world societies demonstrate that abundance is possible when innovation is truly unleashed. The mythology has shifted from "anyone can become rich" to "anyone can destroy a monopoly," creating a society where creative destruction is not just celebrated but actively subsidized by those who profit from keeping the system in constant flux. The result is a world of magnificent chaos, where fortunes are made and lost daily, but where the baseline standard of living has paradoxically risen higher than ever before, lifted by the tide of innovations that no single entity can control or contain.

This hyper-capitalistic vision represents a fascinating synthesis of Joseph Schumpeter's theory of creative destruction and Ayn Rand's Atlas Shrugged philosophy, but with a crucial twist that neither fully anticipated. Schumpeter's central insight - that capitalism progresses through waves of innovation that constantly destroy old industries while creating new ones - reaches its ultimate expression in this society where disruption isn't just a byproduct of competition but the explicitly rewarded goal. The innovation pools and bounties for breaking monopolies are Schumpeterian "gales of creative destruction" weaponized and accelerated through cryptocurrency incentives. Unlike Schumpeter's concern that capitalism might eventually stagnate under corporate bureaucracy, this system ensures perpetual dynamism by making destruction as profitable as creation.

The Randian elements are equally apparent but subverted in unexpected ways. Like Galt's Gulch in Atlas Shrugged, the shadow cities and innovation communes represent withdrawals from corrupt systems - but instead of a single hidden valley of producers, we see thousands of competing autonomous zones. The entrepreneurs and "quasi-criminals" breaking monopolies embody Rand's heroic individualism and contempt for regulatory capture, yet they operate through collective action rather than isolated genius. Where Rand's heroes hoarded their innovations to punish a parasitic society, these actors immediately open-source everything, recognizing that true power comes from network effects rather than scarcity. The system rewards the same ruthless competence Rand celebrated, but channels it toward dismantling rent-seeking rather than defending property rights.

The synthesis reveals something neither thinker fully grasped: that sufficiently advanced capitalism might transcend the very concept of permanent ownership that both assumed was fundamental. Schumpeter worried that innovation would eventually slow under corporate socialism, while Rand feared that collectivism would destroy individual achievement. This society proves both wrong by showing that maximum individualism and maximum collectivism can coexist when mediated by technology and aligned incentives. The result is simultaneously the purest expression of capitalist competition and a form of functional anarchism - a market so free that it continuously destroys the power structures that would seek to control it, where today's Taggart Transcontinental is tomorrow's disruption target, and where the motor of the world runs on open-source code rather than proprietary engines.

The Sovereign Desk editorial is open for conversation. If you’ve observed notable flows, rumours, or data points that warrant attention, please reach out to us:

Dendi Suhubdy at [email protected]

Faisal Mujaddid at [email protected]

Looking to execute large crypto trades with precision, privacy, and zero slippage? Schedule a call with the team at t.me/dendisuhubdy or shoot us an email at [email protected]. Bitwyre’s OTC desk handles high-volume transactions with deep liquidity and bespoke settlement.

We’re also rolling out a stablecoin payments app that lets you bypass OTC entirely, allowing you to use your stablecoins directly for payments at Visa-supported merchants worldwide. Try out the testflight app on iOS here https://testflight.apple.com/join/JEYuqEGQ